Say Goodbye to Payroll Penalties.

What folks are saying about Tax Account Management.

I was spending hours each week trying to manage it all and found that I was still missing things that led to penalties and fines.

Each state has their own set of rules and multiple websites. When I started with Mosey, they took control. They brought my accounts up to date with compliance and provided me with my own portal where everything was organized. It is a tremendous weight off my shoulders having Mosey in control. Now when I need to add a state, I just click a button and let Mosey do the rest.

Mimi Muir

Muir Patent Law

Mosey has truly revolutionized the way we handle state registrations for our fully remote team.

We are in 12 different states now and Mosey has made new state registrations a breeze with their automations. It's incredibly user-friendly, with easy access to each different state and all of their registration info. We've seen a significant reduction in errors and stress related to compliance. If you're looking for a solution that genuinely simplifies and streamlines your operations, Mosey is an absolute must-have. Highly, highly recommend!

Anna Grollmus

Business Manager

.png)

Before Mosey, our team was drowning in manual state registrations across multiple agencies.

Managing vastly different state requirements and interfaces from one intuitive platform has completely eliminated the stress and confusion of compliance. Mosey transformed what was once our biggest headache into a seamless process. We recommend them every chance we get.

Brenna Wagner

Director of Customer Relations

We set up all accounts needed for state payroll taxes with just a couple clicks.

The platform is easy to use and really takes the guesswork out of compliance. And whenever we had any questions, the support team was extremely responsive and solved the issue in one shot. If you are a founder and want time back without losing peace of mind, Mosey is for you!

Jonas Harnau

Co-Founder & CEO

Centralize oversight

-

Every tax account

Stay on top of 1,200+ tax accounts to eliminate operational burden and unlock growth.

-

Powerful workflows

Eliminate manual work by automating registration, tax rate changes, and receiving notices.

-

Put it on autopilot

Never deal with state and local agencies yourself again. Use Mosey to take action on your behalf.

-

Resolve Notices

-

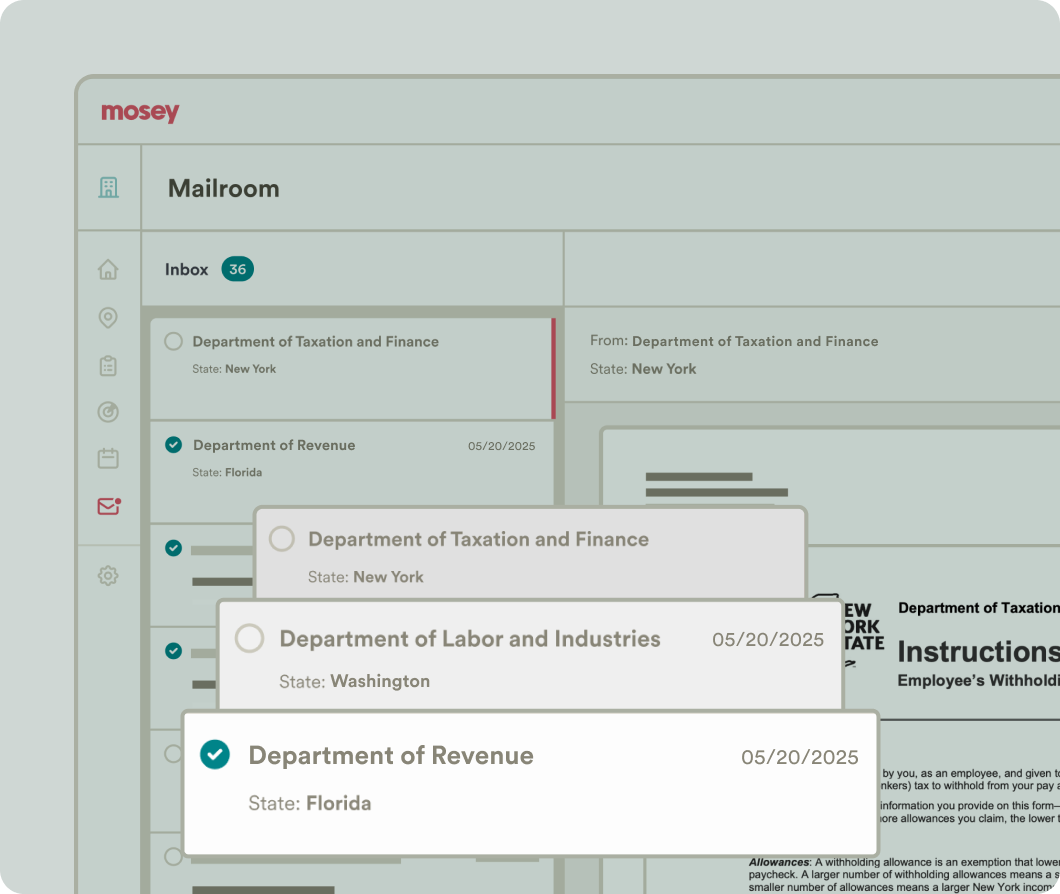

Unified inbox for mail and electronic notices

Receive notices from every channel—physical mail, email, online portals, and registered agents—in one place the moment they arrive.

-

AI summaries and categorization

Leverage Mosey's deep knowledge of agency processes to resolve issues faster.

-

Resolve it for me

Mosey opens a case for each notice and communicates with tax authorities on your behalf. Get flagged only on what truly needs your attention.

-

-

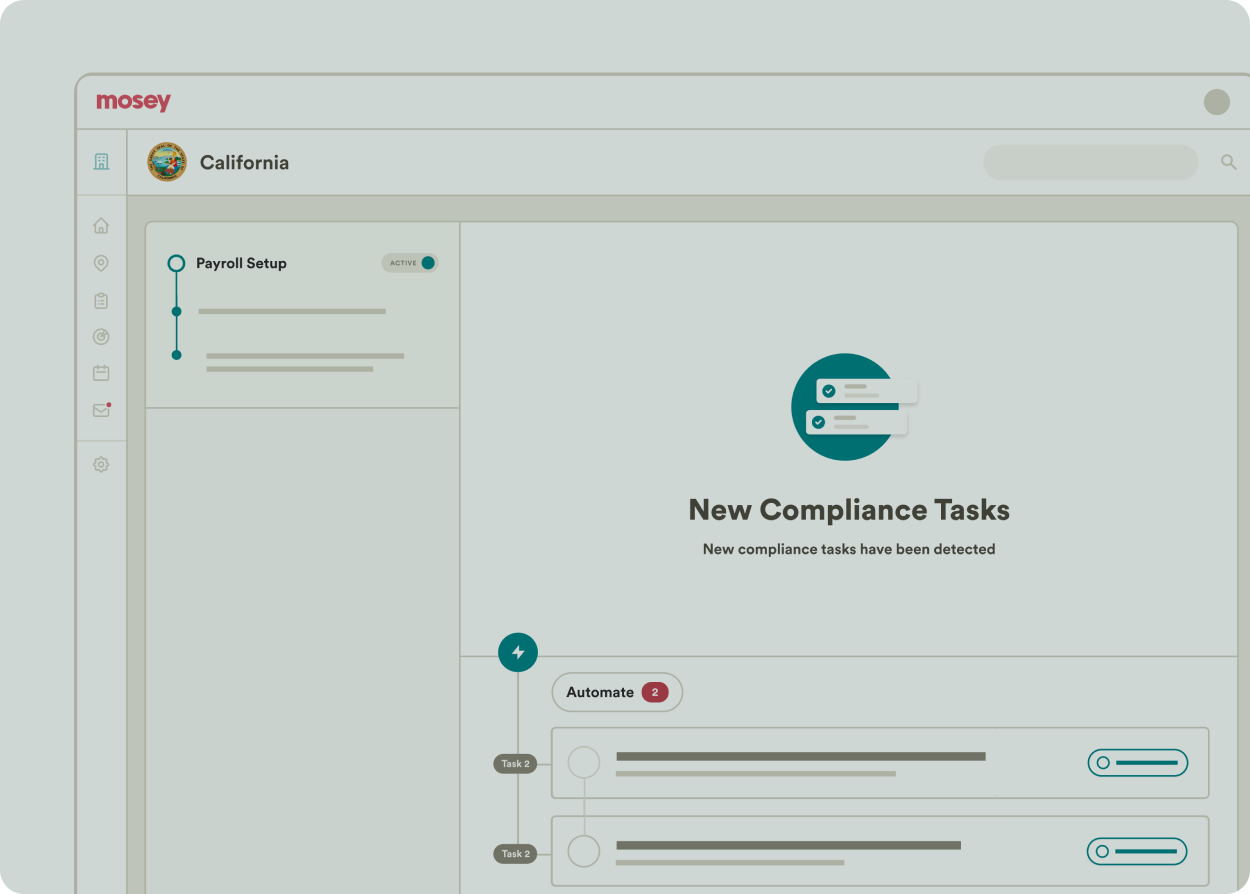

Prevent Penalties

-

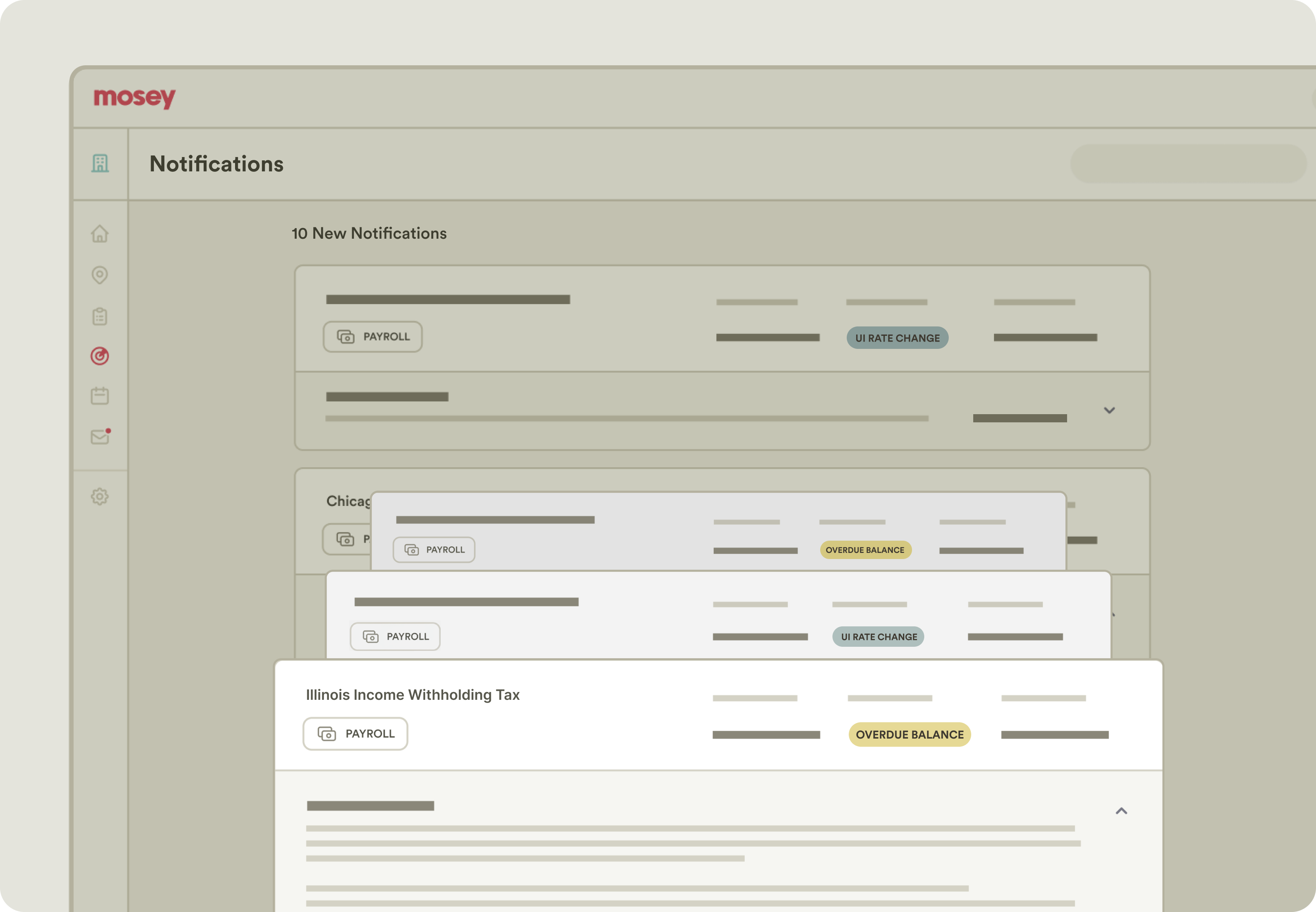

24/7 monitoring

Mosey continuously scans agency portals to identify overdue balances, missing returns, and rate changes.

-

Early warning detection

Get alerted to problems while there is still time to fix them, not after penalties have accrued.

-

Actionable insights

Translate oblique agency language into clear next steps so you know exactly what needs attention.

-

-

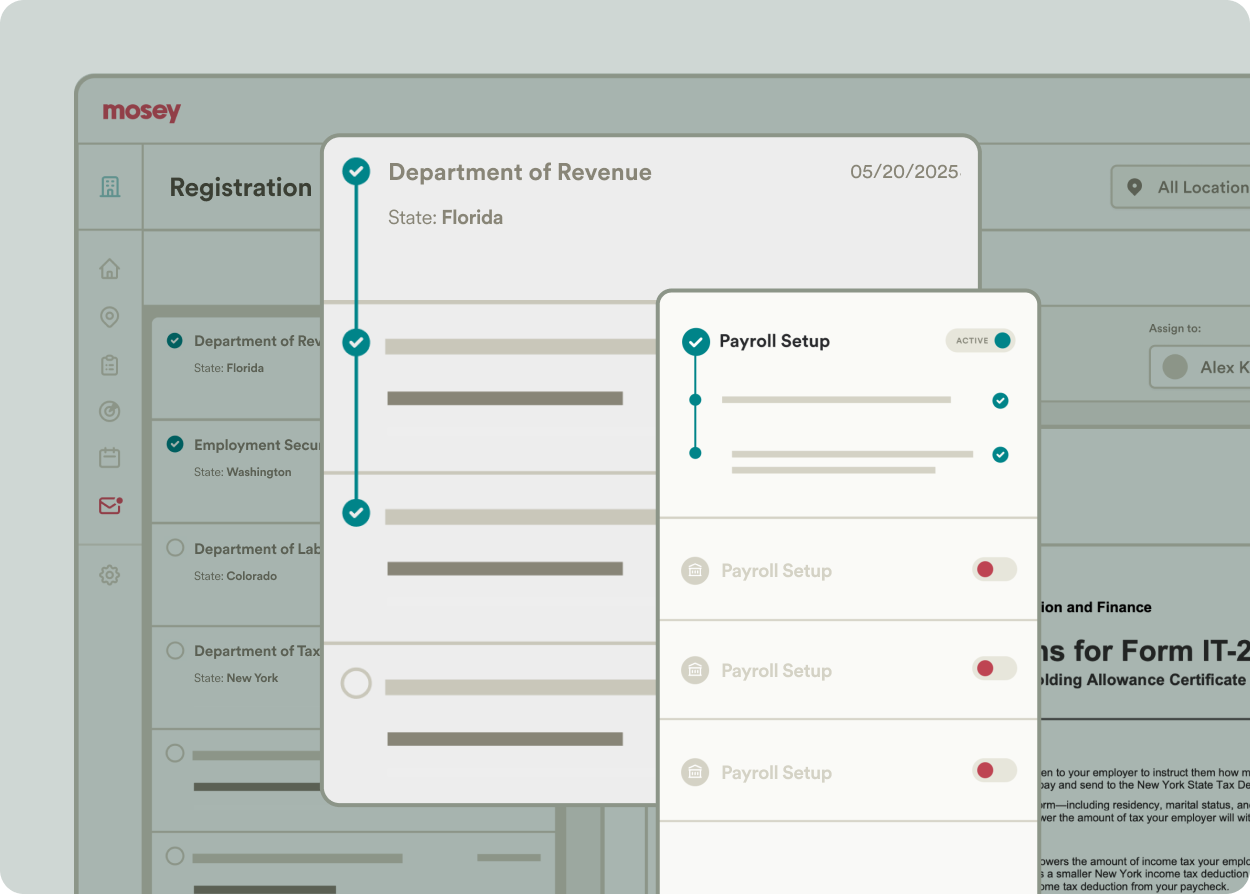

Simplify Registration

-

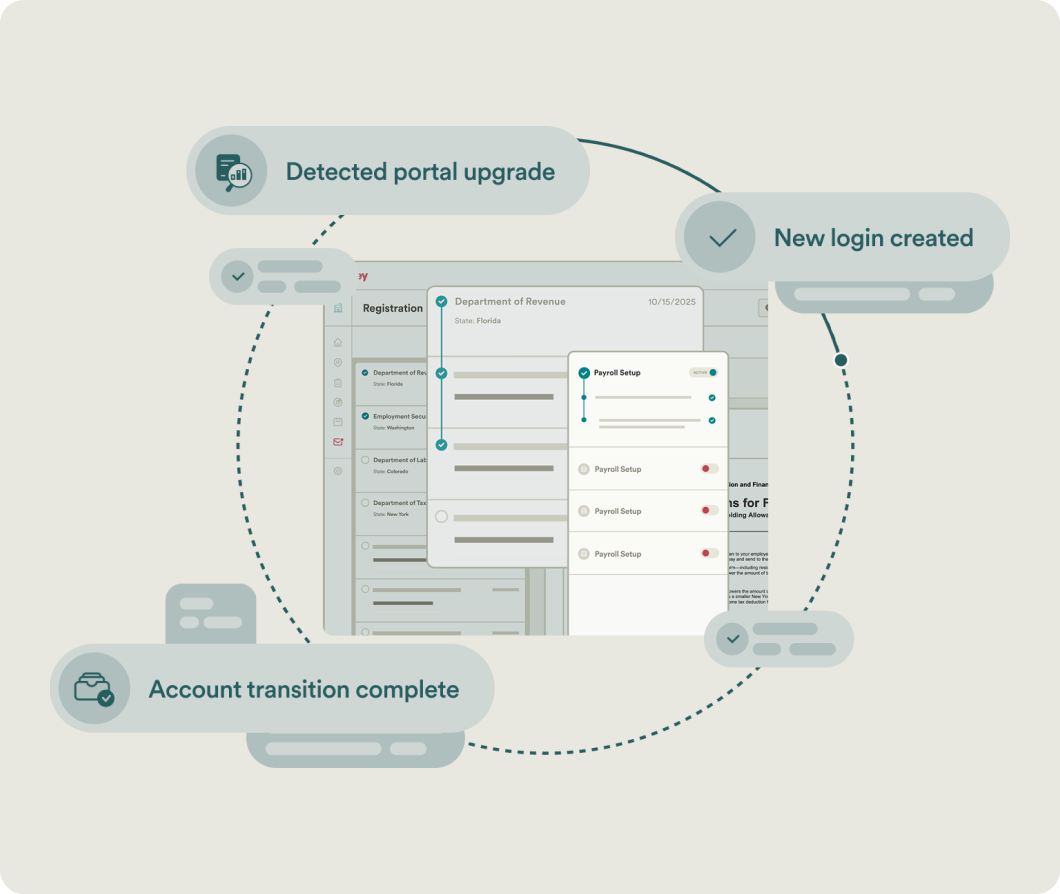

Workforce monitoring

Automatically monitor client workforces for changes that trigger new compliance obligations in real-time.

-

New account registration

Register for payroll tax accounts for new hires in new locations directly in Mosey—no manual forms or agency phone calls.

-

End-to-end management

Mosey handles all paperwork, follow-ups, and verification to ensure registrations are complete and accounts stay current.

.png)

-

Let the numbers speak for themselves.

4,000+ accounts connected

$15.4 billion in payroll

23,000 notices handled

Ready for a tax solution for every scenario?

Speak with a compliance expert to learn more about Tax Account Management.

Built for tax teams, and armies of one

.png)

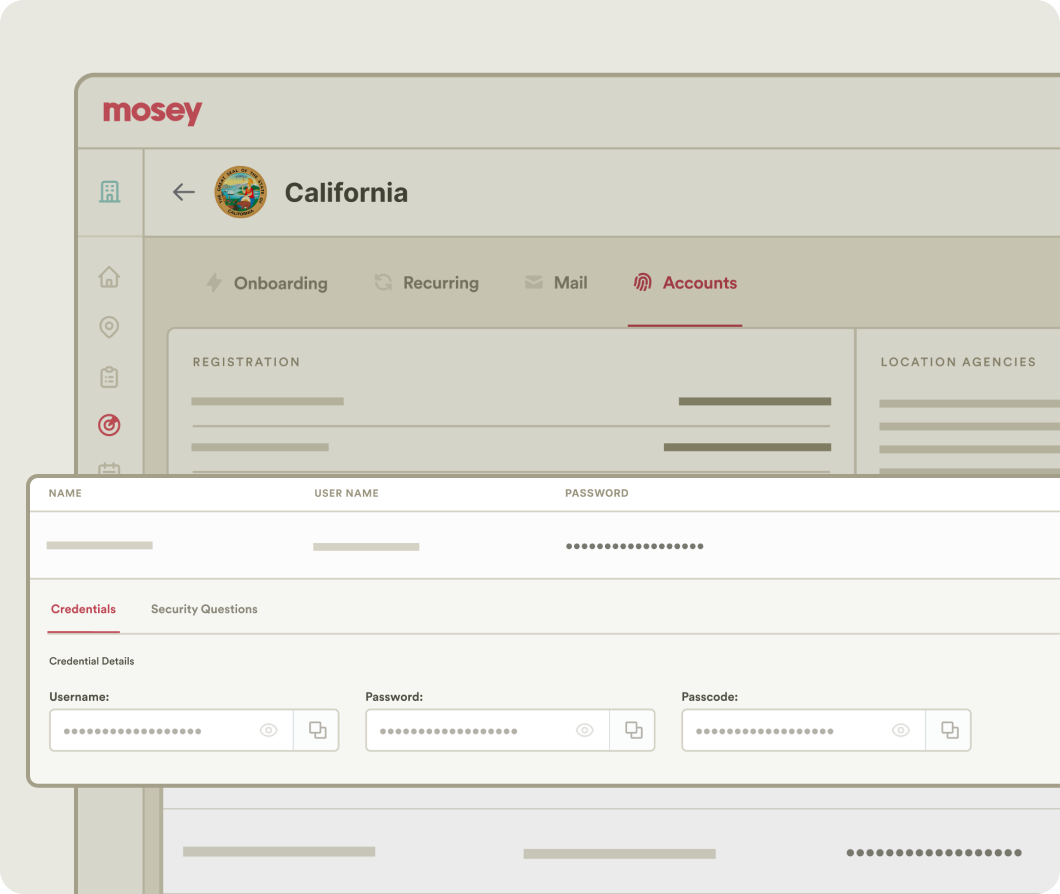

Built for tax teams, and armies of one

Store credentials for every state and local tax account in one secure location. Maintain continuity with shared access that survives turnover.

Passwords are proactively refreshed before expiration, so you will never be locked out of an account at a critical moment.

Seamlessly handle portal migrations when agencies upgrade their technology–no scrambling to regain access.

The most expensive compliance work is what you didn't see coming

- Multi-State Payroll

- Multiple Entities

- Remote Hiring

- Local Taxes

-

-

Employment at scale

A presence in just 10 states can mean managing 30+ active tax accounts.

-

Employee thresholds

In some states, your 2nd, 5th, or 10th hire can qualify the business for additional payroll tax obligations.

-

Inconsistent deadlines

Due dates can differ per state per account with filing frequency depending on the payroll amount.

-

-

-

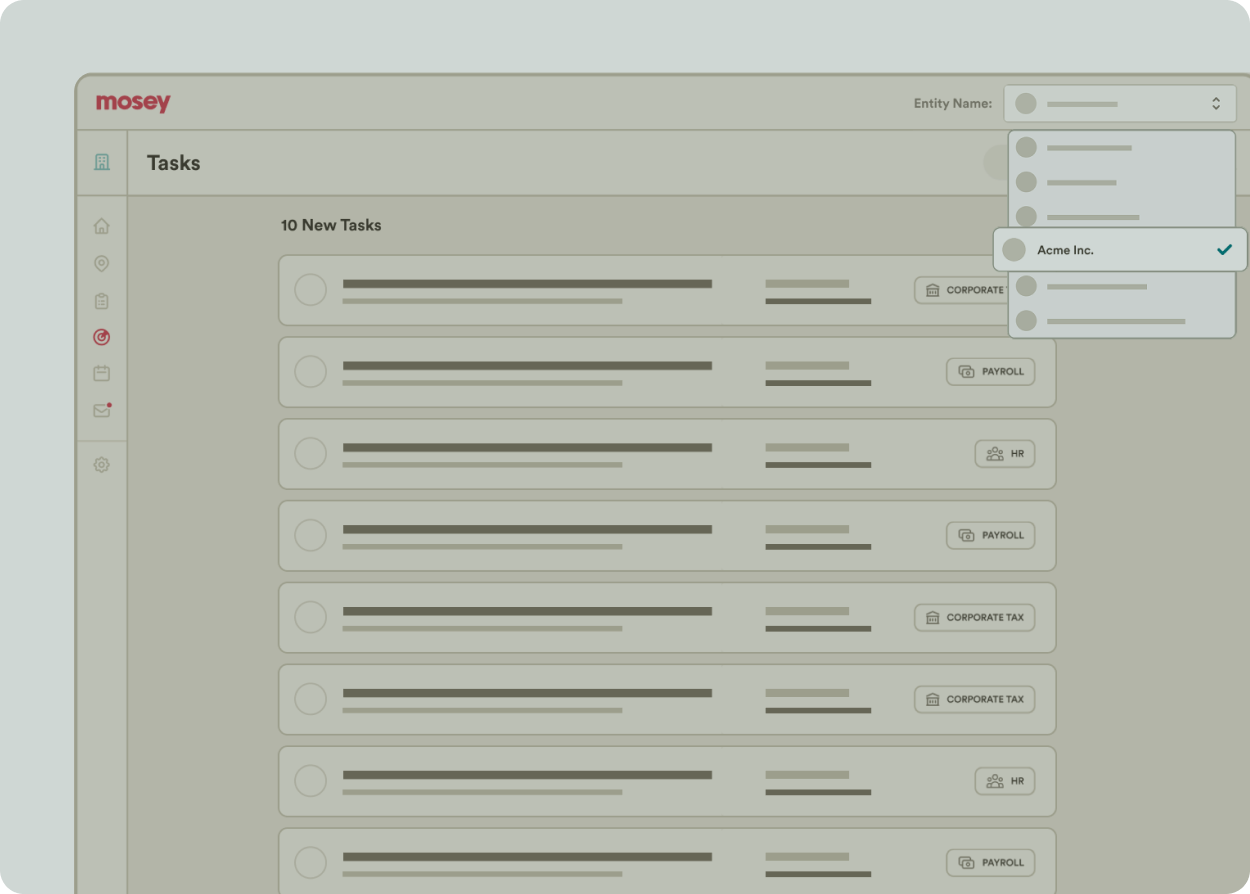

One to many

Subsidiaries, acquisitions, or franchise models multiply their account load exponentially across each registered entity. -

Account overload

Each entity requires its own set of accounts and ongoing monitoring across every state.

-

Team overlap

Team members managing different parts of compliance for multiple entities need tools for organized collaboration.

-

-

-

Mobile workforces and staffing

Businesses with remote workers face constantly shifting compliance obligations as employees move or projects span new locations.

-

Liability matrix

Payroll tax nexus is complex for employees that live and work in different tax jurisdictions.

-

Worker's compensation

Rates vary by state, classification codes change based on location, and some states even require coverage for independent contractors.

-

-

.png)

-

Nexus determination

Employees in localities with payroll tax obligations incur additional registrations and filings for the business.

-

Confusing jurisdictions

Companies with employees in states like OH, KY, and PA navigate dozens of complicated city and county taxes. -

Archaic processes

Local agencies operate on a much smaller scale, often with less intuitive systems for employers.

-

Trusted by

Ready to level up your business?

Speak with a compliance expert to learn more about Tax Account Management.